Table of Contents

What is Taxable Event?

Taxable event is an occurrence of an event which triggers tax liability. The liability doesn’t accrue prior to the event or after the event. The liability is triggered at the point in time when event occurs.

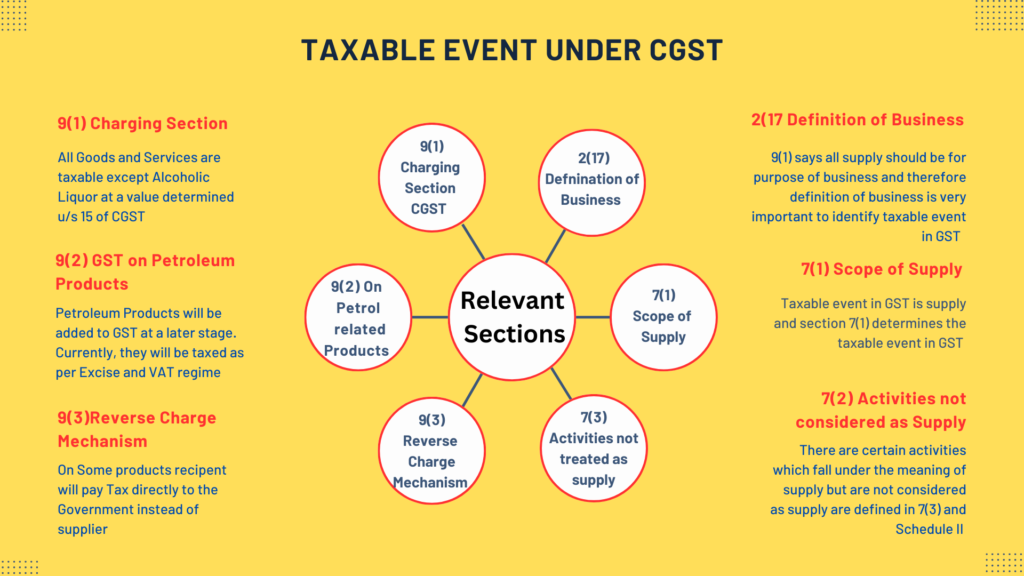

Taxable event in GST is defined in section 9(1) of CGST Act and similar provision is also included in section 5(1) of IGST Act

Here we need to understand the distinction between taxable event and its due date for payment. This can happen at two different point in time. For example, you may supply goods today to your customer. However, GST payment on these goods will be due only on 20th of the subsequent month. This is done for administrative convenience.

Charging Section for Taxable Event in GST

“Supply” of Goods or service both is the Taxable event under GST.

Goods and Services shall include all Goods except supply of alcoholic liquor for human consumption. Further the charging section of GST i.e 9(1) of CGST Act mentions that GST on petroleum products will be levied at a later state. (Reference Section 9(2) of CGST Act)

It is important to note that, Petroleum will be taxed under GST at a future date. However, Liquor for human consumption will not be brought under GST and will remain under state tax.

CGST Act is for intra state (within the same state) movement of Goods.

For movement from one state to another i.e. (Inter state movement) there is a separate act known as IGST Act. The IGST Act has a similar charging section i.e. 5(1)

Term “Supply”

Supply is the taxable event and therefore most important terminology in GST.

Section 7(1) of the CGST act defines “supply” The meaning of “supply” as per the section is very wide and includes

- All forms of supplies of goods or services i.e. sale, transfer, barter, exchange, rental, etc in course or furtherance of business and consideration.

- In case of importation of services condition of furtherance of business is not required and all importation of services are subject to GST under Reverse Charge Mechanism.

- It is important to note that furtherance of business is considered from suppliers’ point of view and not recipient. Thus, if supplier is not in business of supplying Goods or services than, GST is not applicable. If you sell your old Jewellery than it is one time activity, and you are not in business of selling Jewellery. Therefore, GST is not applicable.

- All services provided by a person to its members is considered as a supply. Example A club providing Food and Beverages service to its members will fall under GST. Similarly services provided by a registered trust to its members will be also under the ambit of GST.

- Following activities will be treated as a supply even if without consideration [Schedule I read with section(7)(1) of CGST Act]

- Supply of Goods or services between distinct persons without consideration is considered as taxable event in GST.

Who is a Distinct Person?

As per section 25(4) of CGST Act distinct registrations of GST number by same person will be treated as distinct or separate persons in GST

Thus, a person with a same PAN number but different GST number is a distinct person.

For example, a Large corporate with operations in many states of India will have different GST number for each state. Thus, if there is any stock transfer from one Godowns to another owned by the organisation in different states. Then such transfer will trigger GST.

Thus, Organization will pay GST in sending state and take credit at receiving state.Whether GST applicable on Supply of Goods by HO or one branch / Division to another

Yes GST is applicable

Will Leasing of equipment to its own branch with different GST number be taxable

Leasing of equipment to it’s own branch is taxable

Services by an Indian person to its own branch out side India will be taxable?

No Services by an Indian person to its establishment outside India will not be taxable under GST. Sr. No. 10E of Notification No. 9/2017-IT (Rate) dated 28- 6-2017 as inserted w.e.f. 27-7-2018.

- Supply and receipt of Goods between principal and agent will trigger GST. Even if there is no consideration for transfer of such goods.

- Import of services from a related person without consideration will trigger GST.

- Permanent Transfer or Disposable of Assets where input tax credit is availed will be treated as a supply

- All activities provided by a person to its members will be considered as a supply. In Calcutta Club vs State of West Bengal Hon. SC had held that, a club providing services to its members will not be a taxable and Doctrine of Mutuality will apply. To overcome this ruling provision 7(1)aa was introduced. With this section, services provided by any profit or nonprofit making organization for its members will be taxable under GST.

From above reading of the section it is very clear that “Supply” is an inclusive definition and covers any of the supply of Goods and Services not specifically mentioned in the Section.

Activities not treated as Supply

As per Section 7(2) read with Schedule III following transaction will not be considered as supply.

- Services provided by employee to employer is outside the scope of GST.

- Services performed by Court or Tribunal under any law

- Services provided by MPs, MLAs, or Members of Panchayat or Municipal Corporator etc.

- Funeral, burial, crematorium, or mortuary services, including transportation of the deceased is not covered under GST.

- Sale of Land is not considered taxable under GST.

- Any sale of Flat after issuance of Completion certificate or after first occupation. Thus sale of completed building after completion certificate is not subject to GST.

- Actionable claims, other than lottery, betting or gambling.

- Any movement of goods not entering India.Se

- Any supply or change in title of Goods happening out side India

- Any movement of Goods before clearance of Customs for Home Consumption

- Inter state movement of Modes of Conveyance with or without Goods or passenger which is not used for further supply is not considered as supply under as per the decision of council in CBE&C circular No. 1/1/2017-IGST dated 7-7-2017

- Inter sale movement of goods for repairs and maintenance is not a supply and per clarification of GST Council in CBE&C circular No. 1/1/2017-IGST dated 7-7-2017.

Whether GST is applicable for supply to a related person without consideration?

Supply to a related person in course of business is liable to GST, even if there is no consideration. The valuation rules u/s 15 will apply to determine the value of Goods to charge GST on it.

Whether GST is applicable on perquisite to employees?

It is clarified through CBIC Circular No. 172/04/2022-GST dated 6-7-2022 that, perquisites provided by employer to its employees in terms contractual agreement are in lieu of services provided by employee to employer in relation to his employment. Therefore such perquisites will not be taxable under GST.

GST applicable on nominal charges recovered from employees towards canteen facility?

In Tata Motors [2021] 88 GST 546 The Hon Gujarat AAR held that, GST is not applicable on nominal amount recovered by employer from employees towards canteen charges for providing canteen facilities under Factories Act and paid over to Contractor.

GST applicable on Free or subsidised transport to employees

As per CBIC Circular No. 172/04/2022-GST dated 6-7-2022, perquisites by the employer to its employees in terms of contractual arrangement is not subject to GST. Therefore free or subsidised transport provided to employees is not subject to GST.

Is Insuring employees /their relatives and recovering part premium from them subject to GST

In case of Jotun India (P) Ltd. 76 GST 691 Hon AAR held that, Insuring employees and their relatives and recovering part premium from them for Group Insurance policy is not a supply in furtherance of business and therefore not subject to GST

GST applicable on reimbursement?

GST is not applicable on reimbursement of expenses paid to employees or directors. Provided such expenses are incurred on behalf of the company.

GST applicable on high sea sales?

No High Sea Sales will not attract GST as per Schedule III Para 7

Is GST applicable on Services provided by Employee to Employer?

Services provided by Employer to employee is not subject to GST and is exempt under Entry I of Schedule IIIGST

GST applicability on Partners of a Firm?

Partner is entitled to salary as per basis Partnership Act. It was clarified in Nos. 58 and 71 of Tweet FAQ released by CBE&C on 26-6-2017, that GST is not payable on salary to partners.

Business

As per section 7(1) of CGST Act only those supplies will be charged for GST which are done in course of or for furtherance of business. The requirement of Furtherance of business is not applicable in case of importation of service.

It is important to note understand what does business mean. Business is defined in CGST Act under section 2(17). The definition of business is an inclusive definition and covers following points.

- Profit motive is irrelevant in the concept of business under GST. Thus activities not done with the objective of Profit making will be covered under GST.

- It is not necessary that, business has to be done on regular basis. If any transaction is done as an occasional adventure if will still be considered as business.

- Activites which are incidental or ancillary to main business will be covered under GST. For example if you are in business of manufacturing and also own a car used for official purpose. Sale of Such car will attract GST. Being transaction ancillary to main business of manufacturing.

GST applicable on sale of scrap?

Sale of scrap is connected with the business of assessee and therefore taxable.

Whether GST is applicable on provision of accommodation and food by Charitable institution

Sale of Spiritual Goods and provision of accommodation and food is business of the association and therefore taxable under GST. This was held in AAR Shrimad Rajchandra Adhyatmik Satsang Sadhana Kendra, In re (2018) 69 GST 627

Conclusion

Supply is the taxable event in GST. The definition of supply is very wide and is inclusive. Thus, specific exception from applicability of GST is mentioned in CGST Act.